Investor's Corner

Tesla GigaFactory Economics: Why its critical to $TSLA

Forbes says that success of the GigaFactory is critical to any future increase in Tesla share price. It says production savings will boost profit margins.

Early construction of the Tesla Gigafactory in Reno, NV from Feb, 2015. [Source: Reno Sparks Tahoe Homes]

At present, the lithium to make lithium ion batteries comes mostly from South America. From there it gets shipped to North America for refining and processing. Then it goes to Japan or South Korea for further refining and processing. Finally, it comes back to North America as part of batteries that will be installed in an electric car. That car will then be sold in America, Europe or China. A first year business administration student can tell you there are huge inefficiencies built into that system.

According to Forbes, the genius of the Tesla plan is to consolidate as many of those steps as possible under the roof of its GigaFactory in Nevada. Forbes calculates that even if consolidation only shaves a few percentage points off the cost of each step in the process, the cumulative effect will be significant savings. It estimates savings of 10% are possible in both supply chain costs and labor costs. Then, if the volume of Tesla automobile sales increases, economies of scale should account for a further 10% reduction, for total savings of 30%.

MUST SEE >>> Massive Tesla Gigafactory in HD captured by drone flyover

Based on the prices quoted by Tesla at the roll out of its PowerWall residential battery system in April, analysts believe its cost of manufacture is already at roughly $250 per kilowatt hour. Shaving 30% off that number would drive the cost below $200 per kilowatt hour, and that’s that point where many observers believe electric cars can be price competitive with cars powered by conventional internal combustion engines.

Tesla says it plans to sell 500,000 electric cars a year by 2020. Forbes predicts the product mix to make that number possible will be 20% Model S sedans, 15% Model X SUVs, 5% Roadsters and 60% Model III vehicles. At that sales volume, it estimates the company will realize a 10% gain in its gross profit margins, propelling the company stock 40% higher than its present price target.

But there’s one thing the Forbes report doesn’t take into consideration — the impact on profits from selling batteries for purely non-automotive uses such as grid storage systems coupled with commercial, industrial and residential uses.Large companies like Walmart and Target have already signed deals to use Tesla storage batteries. Amazon will rely on Tesla batteries at its new western service center. And Advanced Microgrid Solutions has just announced an agreement to buy enough Tesla batteries for up to 500 megawatts of electrical storage, according to Bloomberg Business.

AMS CEO Susan Kennedy told Bloomberg, “What I like about the Tesla batteries is that they’re so versatile. But we’re technology agnostic. We can choose any type of technology. We intend to use Tesla batteries on a huge number of our projects going forward.” Meanwhile, Mercedes Benz announced this week that it is jumping into the battery storage business in a big way with its Deutsche ACCUmotive division.

There are billions in profits to be made in stationary battery storage systems over the next 20 years, as the world of electrical power transitions away from fossil fuels to distributed renewables. It may turn out that Tesla’s battery business could generate more profits than its automobile business. In which case, Forbes’ prediction of a 40% increase in Tesla share price may prove to be entirely too conservative.

Source: Forbes

Investor's Corner

Tesla negativity “priced into the stock at its current levels:” CFRA analyst

The CFRA analyst has given Tesla a price target of $360 per share.

In recent comments to the Schwab Network, CFRA analyst Garrett Nelson stated that a lot of the “negative sentiment towards Tesla (NASDAQ:TSLA) is priced into the stock at its current levels.”

The CFRA analyst has given Tesla a price target of $360 per share.

Q1 A Low Point in Sales

The CFRA analyst stated that Tesla’s auto sales likely bottomed last quarter, as noted in an Insider Monkey report. This was, Nelson noted, due to Q1 typically being the “weakest quarter for automakers.” He also highlighted that all four of Tesla’s vehicle factories across the globe were idled in the first quarter.

While Nelson highlighted the company’s changeover to the new Model Y as a factor in Q1, he also acknowledged the effects of CEO Elon Musk’s politics. The analyst noted that while Tesla lost customers due to Musk’s political opinions, the electric vehicle maker has also gained some new customers in the process.

CFRA’s Optimistic Stance

Nelson also highlighted that Tesla’s battery storage business has been growing steadily over the years, ending its second-best quarter in Q1 2025. The analyst noted that Tesla Energy has higher margins than the company’s electric vehicle business, and Tesla itself has a very strong balance sheet.

The CFRA analyst also predicted that Tesla could gain market share in the United States because it has less exposure to the Trump administration’s tariffs. Teslas are the most American-made vehicles in the country, so the Trump tariffs’ effects on the company will likely be less notable compared to other automakers that produce their cars abroad.

Investor's Corner

Tesla average transaction prices (ATP) rise in March 2025: Cox Automotive

Tesla Model Y and Model 3 saw an increase in their average transaction price (ATP) in March 2025.

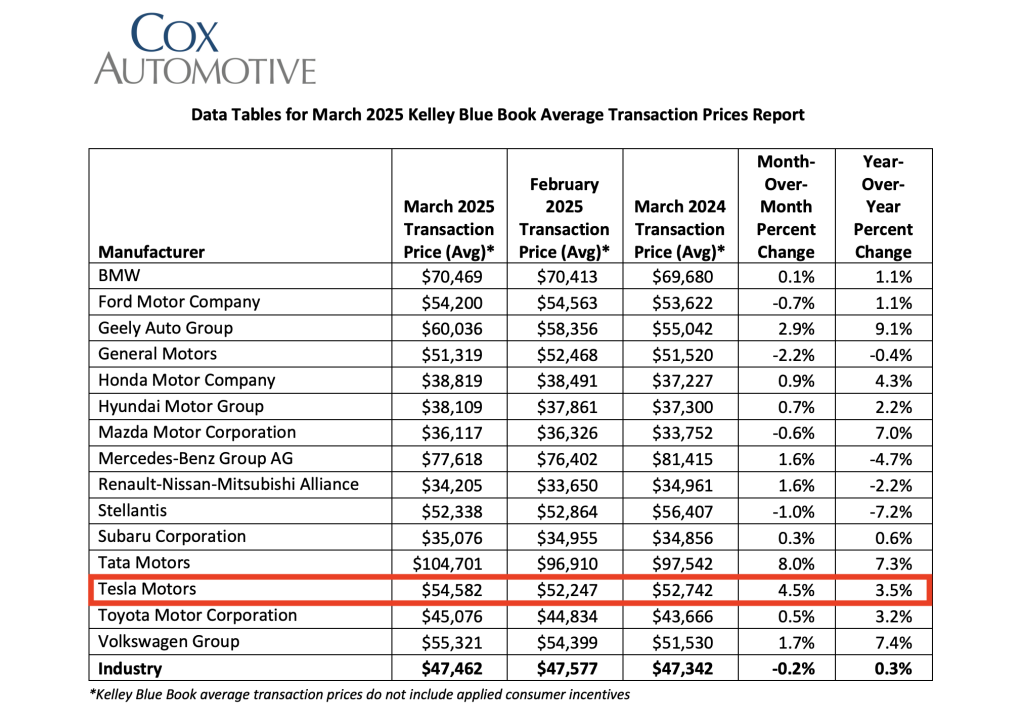

Data recently released from Cox Automotive’s Kelley Blue Book has revealed that electric vehicles such as the Tesla Model Y and Model 3 saw an increase in their average transaction price (ATP) in March 2025.

Cox Automotive’s findings were shared in a press release.

March 2025 EV ATPs

As noted by Cox, new electric vehicle prices in March were estimated to be $59,205, a 7% increase year-over-year. In February, new EV prices had an ATP of $57,015. The average transaction price for electric vehicles was 24.7% higher than the overall auto industry ATP of $47,462.

As per Cox, “Compared to the overall industry ATP ($47,462), EV ATPs in March were higher by nearly 25% as the gap between new ICE and new EV grows wider. EV incentives continued to range far above the industry average. In March, the average incentive package for an EV was 13.3% of ATP, down from the revised 14.3% in February.”

Tesla ATPs in Focus

While Tesla saw challenges in the first quarter due to its factories’ changeover to the new Model Y, the company’s ATPs last month were estimated at $54,582, a year-over-year increase of 3.5% and a month-over-month increase of 4.5%. A potential factor in this could be the rollout of the Tesla Model Y Launch Series, a fully loaded, limited-edition variant of the revamped all-electric crossover that costs just under $60,000.

This increase, Cox noted, was evident in Tesla’s two best-selling vehicles, the Model 3 sedan and the Model Y crossover, the best-selling car globally in 2023 and 2024. “ATPs for Tesla’s two core models – Model 3 and Model Y – were higher month over month and year over year in March,” Cox wrote.

Cox’s Other Findings

Beyond electric vehicles, Cox also estimated that new vehicle ATPs held steady month-over-month and year-over-year in March at $47,462, down slightly from the revised-lower ATP of $47,577 in February. Sales incentives in March were flat compared to February at 7% of ATP, though they are 5% higher than 2024, when incentives were equal to 6.7% of ATP.

Estimates also suggest that new vehicle sales in March topped 1.59 million units, the best volume month in almost four years. This was likely due to consumers purchasing cars before the Trump administration’s tariffs took effect. As per Erin Keating, an executive analyst at Cox, all things are pointing to higher vehicle prices this summer.

“All signs point to higher prices this summer, as existing ‘pre-tariff’ inventory is sold down to be eventually replaced with ‘tariffed’ inventory. How high prices rise for consumers is still very much to be determined, as each automaker will handle the price puzzle differently. Should the White House posture hold, our team is expecting new vehicles directly impacted by the 25% tariff to see price increases in the range of 10-15%,” Keating stated.

Investor's Corner

Tesla bull sees company’s future clearly: Cathie Wood

ARK Invest’s Cathie Wood remains bullish as TSLA rebounds. Trump tariffs loom, but Wood says Tesla’s U.S. supply chain gives it an edge.

ARK Invest’s Cathie Wood explained her bullish stance on Tesla once again. Tesla shares dropped after a challenging first quarter. However, TSLA stock surged on Wednesday, proving Wood’s optimism was right on the money.

In an interview with Barron’s, Wood enumerated a few reasons ARK Invest sees a bright future for Tesla. She predicts that Tesla will launch a cheaper electric vehicle (EV), starting at around $30,000—half the price of a typical Model Y. “This will help bring affordability back into auto buying,” Wood said.

Tesla’s $30,000 EV model is expected to launch this quarter. However, Tesla is already refreshing its EV lineup and offering cheaper models. It debuted a Long Range All-Wheel-Drive Model Y “Juniper” in the U.S. on April 4, priced at $48,990 before a $7,500 tax credit.

Wood also touted Tesla’s upcoming robotaxi service, which she predicts will help consumers save upfront costs that would usually go to buying a new car. The ARK Invest CEO argues that Tesla’s robotaxi service would be cheaper than Uber and Lyft because it would save costs without a human driver.

Benchmark analyst Mickey Legg echoed Wood’s prediction in a recent note. Legg believes the negative narrative surrounding Tesla is exaggerated. The Benchmark analyst encouraged investors to look at the catalysts that could drive TSLA stocks up, like its AI developments.

Similar to Legg, Wood brushed off concerns about Elon Musk’s ties to Trump and negativity surrounding Tesla stock. “News cycles pass quickly nowadays, and the best cars are going to win.”

The ARK Invest CEO also shared her thoughts on Trump’s tariffs and how they would affect companies like Tesla.

“When businesses and consumers are scared, they’ll change the way they do things, and that’s usually good for the companies that are helping others do things better, cheaper, faster, more creatively, and more productively,” she said.

Wood noted that Tesla’s heavy North American sourcing will soften tariff blows. With affordability and tech in focus, Wood sees Tesla forging ahead despite Trump’s tariffs.

-

News1 week ago

News1 week agoTesla rolls out new, more affordable trim of the Model Y Juniper in U.S.

-

News2 weeks ago

News2 weeks agoTesla shares Optimus’ improved walk in new update video

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoMusk says xAI has acquired X in $33 billion stock deal

-

Elon Musk1 week ago

Elon Musk1 week agoTesla Germany reports 4,935 units sold in Q1 2025

-

Investor's Corner2 weeks ago

Investor's Corner2 weeks agoTesla (TSLA) shares company-compiled Q1 2025 delivery consensus

-

News1 week ago

News1 week agoTesla expands Early Access Program (EAP) for early Full Self-Driving testing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoNYC Comptroller moves to sue Tesla for securities violations

-

News7 days ago

News7 days agoTesla celebrates key milestone for 4680 battery cell production cost