Investor's Corner

Tesla SolarCity merger may be delayed by shareholder lawsuits

A special stockholder meeting in connection with Tesla’s proposed SolarCity acquisition is coming soon.

Over the weekend, Tesla published two items related to the acquisition: a notice of an upcoming event, the Record Date for the Upcoming Tesla Special Stockholder Meeting in Connection with SolarCity Acquisition, and an update the the S-4 Registration Statement, a.k.a the Merger Proposal.

In the first announcement Tesla intends to inform Tesla investors that the “record date for the determination of Tesla stockholders entitled to […] vote at the Tesla special stockholders meeting in connection with the SolarCity acquisition will be sometime during the week of September 19, 2016.” In layman terms, this means that sometime this week, anyone that “settled” a TSLA stock purchase 3 days prior to this date will have the right to vote at the Tesla special stockholders meeting.

Because of the T+3 system of settlement presently used in North America whereby stock trades settle three business days after the transaction is carried out, anyone purchasing TSLA stock this week will likely be unable to vote at the Tesla special stockholders meeting.

The second filing is an update to the original S-4 Registration Statement of August 31, 2016. Comparing the two version of the Merger Proposal, shows that the documents are effectively identical, except for a section entitled “Litigation Relating to the Merger” (on page 23 of the latest PDF).

In this section of the Merger Proposal, Tesla discloses that “between September 1, 2016 and September 14, 2016, four lawsuits were filed in the Court of Chancery of the State of Delaware by purported stockholders of Tesla challenging the proposed Merger.” These lawsuits were filed by the City of Riviera Beach Police Pension Fund, Ellen Prasinos, the Arkansas Teacher Retirement System, and P. Evan Stephens.

In the lawsuits it is alleged “that the members of the Tesla Board breached their fiduciary duties in connection with the proposed Merger and, in some cases, that SolarCity and members of the SolarCity Board aided and abetted breaches of fiduciary duties and that certain individual defendants would be unjustly enriched by the proposed Merger.”

Additionally the lawsuits claim that “Member of the Tesla Board [..] [in the S-4 document] filed on August 31, 2016 allegedly failed to disclose material facts in connection with the proposed Merger.”

The main goal of the lawsuits is the rescission of the proposed Merger. Tesla of course believes that the actions are without merit.

What does this all means? Probably not too much. The record date will be announced this week, and soon after the Tesla special stockholders meeting in connection with the SolarCity acquisition will be held. Approval is expected, given that most of the large shareholders, Mutual Funds and major Hedge funds, have already announced their approval.

The lawsuits, unless thrown out by the appointed judge, will likely only delay the actual closing off the agreement. One thing to also note is that almost every merger agreement results in shareholders lawsuits, so the Tesla situation is fairly common.

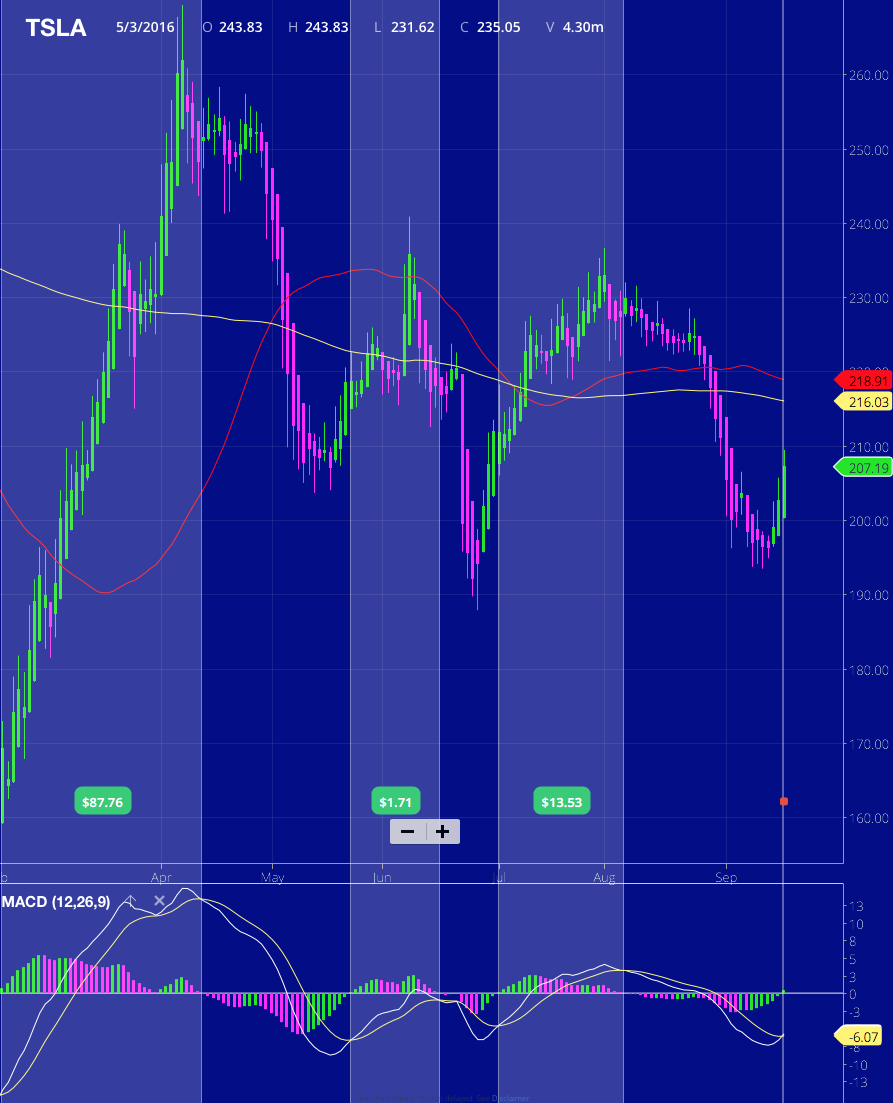

TSLA Stock Action

TSLA stock is now officially back on the run. Looking at today’s chart, most of the technical indicators have now turned positive: we have 3 green bars of the Heikin-Ashi chart (the pay-day-cycle, showing the momentum is on the upside), the MACD has turned positive and the MACD averages are “pinching”. This was enough for me to initiate a buy on Friday of TSLA January 2017 $200 calls.

Source: Wall Street I/O

Investor's Corner

LIVE BLOG: Tesla (TSLA) Q1 2025 Company Update and earnings call

The following are live updates from Tesla’s Q1 2025 earnings call.

Tesla’s (NASDAQ:TSLA) Q1 2025 earnings call comes on the heels of the company’s Q1 2025 Update, which was released after the closing bell on April 22, 2025.

Tesla’s Q1 2025 Results:

- Total Revenues: $19.3 billion

- Total automotive revenues: $13.967 billion

- Total GAAP gross margin: 16.3%

- Gross Profit: $3.15 billion

- EPS non-GAAP: $0.27 per share

- Free cash flow: $664 million

The following are live updates from Tesla’s Q1 2025 earnings call. I will be updating this article in real time, so please keep refreshing the page to view the latest updates on this story.

16:20 CT – Hello, and happy earnings day to everyone! While Tesla missed the Street’s expectations, the stock has not shown its typical volatility at all. That being said, this earnings call is quite interesting due to the upcoming “Company Update.”

Tesla also reiterated its section about new vehicles that “remain on track for start of production in the first half of 2025” in its Update Letter. What are these vehicles? Just variants of the Model 3 or Model Y? Was the Cybertruck LR RWD one of them already? Or are they actually new cars that we’ve just never seen before?

Either way, ten minutes and counting.

16:27 CT – Now I’m just curious if the Company Update will be a video. The thumbnail Tesla is using on X and YouTube shows an “Audio Webcast Only” graphic though. Three minutes and counting.

16:28 CT – And there’s the music. Wonder if it’s going to be on time.

16:34 CT – Annd we’re now on the Elon time threshold. Tesla stock is actually up 4% in after-hours today. Pretty nutty considering that the Q1 earnings are a miss.

16:36 CT – The earnings call is formally starting. Here we go.

Elon Musk takes the stage. “There’s never dull moment these days,” he said. He admits to the blowback from his work with DOGE. He also admitted that those against DOGE are bound to attack him and his companies, such as Tesla. Musk reiterates his belief that it’s important to fight waste and fraud. “I think it’s critical work,” Musk said.

16:40 CT – Musk discusses the protests against Tesla. He alleges that the protests are not organic. “The actual reason for the protests is that those who are receiving the waste and fraud want to continue receiving the waste and fraud,” he said.

Musk notes that starting next month, in May, his time allocation for DOGE will drop significantly. He will continue to spend a day or two on government matters or as long as the U.S. President wishes him to. “Starting next month, I will be allocating more of my time with Tesla,” Musk stated.

16:43 CT – Musk noted that Tesla is no stranger to challenges, but Tesla has been through the ringer several times in the past. “We’re not on the ragged edge of death….not even close,” he said.

He also highlighted that Tesla is on the cusp of autonomous cars and autonomous humanoid robots. Musk expects unexpected bumps this year, but he remains confident on the future of Tesla. The idea of Tesla potentially being the most valuable company in the world by far was reiterated. “Maybe as valuable than the next five companies combined,” he said.

“We expect to be selling fully autonomous rides in June in August,” Musk stated. He also stated that autonomy in cars will affect the bottom line by mid-2026.

16:47 CT – Musk discusses Tesla’s supply chain, highlighting that Tesla is the least affected automaker by the Trump tariffs. That being said, Tesla has been working to localize its supply chains for years. He admitted that tariffs are tough on companies where the margins are so low. Musk also clarified that he continues to advocate for lower tariffs, but that’s all he can do. Trump has the decision.

“The tariff decision is entirely up to the President of the United States. I will weigh in on the decision, but its primarily up to the President. I continue to advocate for lower tariffs rather than higher tariffs,” Musk said.

16:50 CT – Musk noted that he would now explain why he is very excited for Tesla’s future. He noted that Tesla is laser-focused on bringing autonomy in June in Austin, Texas. He highlights Tesla’s general approach to autonomy.

“We have a general solution (to autonomy) rather than a specific solution,” Musk said.

He also noted that Tesla expects to use thousands of Optimus robots in its factories this year. He expects Optimus’ ramp would be one of the fastest. By 2030, or 2029, a million Optimus per year is plausible.

16:52 CT – Musk highlighted that the Tesla Energy unit is doing very well. “We expect the stationary energy storage to scale to terawatts per year,” he said.

16:54 CT – Musk stated that Tesla chose to update the Model Y in Q1 because the first quarter tends to be the weakest. People do not usually buy a lot of cars in winter, after all. He highlighted that the Model Y is the world’s best-selling cars.

“We picked Q1 to cut over to the production of the new Model Y…at the same time in factories across the world,” Musk stated, adding that, “In conclusion, while there are many headwinds, the future of Tesla is brighter than ever.”

He thanks the Tesla team and stated that he is looking forward to leading the team.

16:56 CT – Tesla CFO Vaibhav Taneja takes the stage. He explained the company’s reduced vehicle deliveries, which were caused by the changeover to the new Model Y across its factories. He also noted that the negative effects of vandalism and unwarranted hostility towards Tesla and its staff affected sales in some areas.

The CFO noted that even with these challenges, Tesla was able to sell out legacy Model Y in Q1. “We have an extremely competitive vehicle lineup and after that we have FSD,” he said.

17:03 CT – Taneja noted that the Powerwall 3 has been received well by customers and Tesla is currently supply constrained.

He also discusses the effects of tariffs, though he highlighted that Tesla is a very American automaker. Tesla is not immune to the tariffs, but the company could navigate the challenging landscape better than other automakers. That said, Tesla’s US lineup complies with USMCA by 85%. The company is working on non-China battery suppliers as well.

17:06 CT – Say Questions begin. First up is a question about the highest risk items on the critical path to robotaxi launch and scaling. Elon stated that robotaxis in June in Austin will be comprised of a Model Y fleet.

“Teslas that will be fully autonomous in Austin will be Model Ys,” Musk said, adding that Tesla’s paid autonomous rides will be coming to other cities later this year. “I predict there will be millions of Teslas operating fully autonomously in the second half of next year [in the US].”

Musk did state that there will be some localized parameters for Tesla’s paid autonomous rides in different regions, like snowy areas. A good driver in California won’t be as good in the middle of a blizzard in winter, after all.

17:09 CT – Ashok Elluswamy, VP of Autopilot/AI Software at Tesla, noted that localized parameters still follow Tesla’s general approach to autonomous cars. He also highlighted that validation is still critical for robotaxi operations. In Tesla’s factories today alone, there could be many days without interventions, making it hard to figure out if FSD Unsupervised is working as intended.

Musk and Taneja joked that Tesla customers in China are really pushing FSD to its limits. People in China “putting [FSD] to the real test,” Musk stated.

Cybercab is also in sample validation now, and it’s still scheduled for production next year.

17:12 CT – Another question is asked, this time about when FSD Unsupervised will be released. “Before the end of this year” in the United States, Musk stated, adding that FSD Unsupervised must be meaningfully safer than human drivers before it is released.

17:15 CT – A question about Tesla’s new cheaper models is asked, and if the company is focused on simplified versions to enhance affordability, similar to the RWD Cybertruck.

Tesla VP of Vehicle Engineering Lars Moravy noted that these cheaper vehicles are still on track. The ramp is slower than we hoped but nothing is blocking the company from initial production.

17:21 CT – Another question is asked, this time about how FSD Unsupervised will compete against Waymo’s offering, especially regarding pricing, geofencing and regulatory flexibility.

“The issue with Waymo’s cars is that it cost waayy more money,” Musk joked. He also stated that Teslas cost a quarter or 20% what a Waymo cost, and the company’s vehicles are made in large volume.

Musk predicts 99% market share for robotaxi unless other companies can deploy the same amount of vehicles on the roads as Tesla. “I don’t see anyone being able to compete with Tesla at present,” he stated.

By the end of the year Musk is confident that the Model Y will drive itself all the way to the customer autonomously from the factory.

17:25 CT – A question about the unboxed method and how that is progressing was also asked. Tesla notes that the company’s unboxed process is progressing. “You’ll see it on tests and roads in the coming months.” Tesla is also focused on improving the method, like marrying sub-assembly areas together. “This is a revolutionary production system,” Musk noted.

When describing the Cybercab line, Musk stated that “it will ultimately achieve a cycle time of 5 seconds or less.” So far, Tesla is fastest at 33 seconds in Giga Shanghai.

17:29 CT – A question about tariffs and political biases was asked. The executives noted that Tesla is very localized already. Localization for Tesla is 85% in North America and 95% in China. “We’re ridiculously vertically integrated,” Musk stated.

Tesla makes lithium, cathode and cells. Only thing left is the anode. Musk also stated that Tesla’s in-house cells are the most competitive.

17:34 CT – A question was asked if Tesla has battery supply constraints. Tesla executives noted that while tariffs pose a challenge, Tesla is prepared to face it. Tesla is also not battery constrained for vehicles.

17:36 CT – Another question was asked, this one about “brand damage.” Executives highlighted that Q1 was all about the new Model Y changeover, and the company is still dominating its segments. “Tesla is not immune to the macro demand for cars,” executives noted.

17:39 CT – A question is asked about Optimus’ production line. Musk noted that Optimus is still in development, so most of its production will be at the end of the year. He also noted that most things for Optimus production is new, so it’s ramp has its challenges.

Musk noted that Optimus is affected by the Trump administration’s tariffs against China since the humanoid robot uses robots from the country. Elon Musk also reiterated the idea that Tesla will produce 5,000 Optimus robots this year.

17:40 CT – Analyst questions begin. Pierre Ferragu of New Street Research discussed the market share of Tesla’s cars. Musk noted that “the reality is in the future most people aren’t going to buy cars.” The CEO recalled that when the iPhone came out, veteran phone makers like Nokia opted to continue making legacy products. Consumers, however, wanted the most intelligent product available.

17:43 CT – Emmanuel Rosner from Wolfe asked about the FSD and its required number of human interventions. What still needs to happen for FSD to be Unsupervised? Tesla noted that it is aware of aware of the interventions happening in public FSD, and the robotaxi service rolling out in a couple of months will be focused on key areas. “We really working through a long tail of unusual interventions,” Tesla executives noted.

When asked if Tesla will need remote operators, Tesla noted that the robotaxi service in Austin will use use them, but only if absolutely needed.

17:46 CT – Edison from Deutsche Bank asked how Optimus’ supply chain will look like. Musk noted that Tesla is focused on localization, especially considering geopolitical uncertainty. The analyst followed up with the number of robotaxis in Austin in June. Musk noted that Day 1, there will probably be 10 cars to observe.

17:49 CT – A Cannaccord analyst asked about FSD pricing. Tesla executives noted that people who bought FSD typically believe that FSD is too cheap, especially its monthly subscription. Granted, FSD is insistent that drivers pay attention to the road, which affects the pricing. But when FSD is already fully unsupervised, that monthly fee will feel very affordable.

When asked about the Indian market, Tesla explained that India is a very hard market because of its taxes.

17:53 CT – Colin Langan from Wells Fargo asked about Tesla’s vision based approach and how the company plans to get around issues like sun glare and dust. Musk noted that Tesla uses Direct Photon Counting to see clearly through fog, dust, and sun glare. With this, Teslas can drive directly facing the sun or in extremely dark environments.

The analyst asked if the affordable cars will just be a cheaper Model Y. In response, Lars Moravy noted that Tesla is using its existing lines, limiting the design of the cheaper model. The new cars will depend on existing lines, so least their form factor will be familiar.

17:57 CT – Adam Jonas of Morgan Stanley asked about the Trump tariffs. Musk highlighted that he is just one of many advisers, and he does not make decisions. “I am an advocate for predictive tariff structures,” Musk noted.

As a follow up, Jonas asked if Musk believes the US or China is ahead in the development of AI humanoids and drones. Musk laughed and noted that it’s obvious which one is ahead in drones. America sadly cannot manufacture its own drones, and China holds a notable amount of the supply chain. Musk highlighted that US should not depend so much on China to make drones.

He noted that Tesla and SpaceX will be at the top of companies’ rankings, but he is apprehensive that ranks 1 through 10 will all be Chinese companies.

18:02 CT – And that wraps up Tesla’s Q1 Company Update and earnings call! Tesla really answered a lot of questions in this call, making it one of the longest Q&A sessions to date.

With that, till the next time, everyone!

Tesla’s livestream of its Q1 2025 Company Update and earnings call can be viewed below.

Investor's Corner

Tesla (TSLA) releases first quarter 2025 earnings results

Tesla’s quarter-end cash, cash equivalents and investments stand at a healthy $37 billion.

Tesla’s Q1 2025 earnings were released in an Update Letter, which was posted on the company’s Investor Relations website after markets closed today, April 22, 2025.

Tesla Q1 2025 Deliveries

Tesla’s first quarter vehicle deliveries fell short of expectations, with the EV maker delivering a total of 336,681 vehicles, comprised of 323,800 Model 3/Y and 12,881 other models, worldwide. Vehicle production was at 362,615 units in the first quarter, comprised of 345,454 Model 3/Y and 17,161 other models.

Tesla Energy continued its momentum in Q1 2025, with the division deploying 10.4 GWh of energy storage products during the quarter.

What Wall Street Expects

As noted in a Forbes report, expectations are high that Tesla will report a gain of $0.35 per share on $21.85 billion in revenue, though whisper numbers suggest that the company will only post a gain of $0.31 per share. Analysts polled by FactSet expect Tesla to see an EPS of $0.41 per share on revenues of $21.27 billion, as noted in an Investors’ Business Daily report.

Tesla’s Q1 2025 Results In a Nutshell

Following are highlights of Tesla’s Q1 2025 update Letter:

- Total Revenues: $19.3 billion

- Total automotive revenues: $13.967 billion

- Total GAAP gross margin: 16.3%

- Gross Profit: $3.15 billion

- EPS non-GAAP: $0.27 per share

- Free cash flow: $664 million

Key Updates:

Tesla’s total revenue decreased 9% YoY to $19.3 billion YoY. This was due to a decline in vehicle deliveries, in part due to the new Model Y changeover and reduced vehicle average selling price (ASP), among other factors.

Tesla is still profitable, though operating income decreased 66% YoY to $0.4 billion. This also resulted in a a 2.1% operating margin. Tesla’s profitability in the first quarter was affected by reduced vehicle ASP, a decline in vehicle deliveries, and an increase in operating expenses driven by AI and other R&D projects partially offset by a decrease in SG&A, among other factors.

Tesla’s quarter-end cash, cash equivalents and investments stand at a healthy $37 billion. The sequential increase of $0.4 billion was primarily the result of positive free cash flow of $0.7 billion.

Below is Tesla’s first quarter 2025 Update Letter.

TSLA-Q1-2025-Update by Simon Alvarez

This article is being updated.

Investor's Corner

Tesla (TSLA) Q1 2025 earnings: What to expect

Tesla stock reached as high as $488.54 per share in 2024, though it is trading at around $240 per share as of writing.

Tesla (NASDAQ:TSLA) is expected to release its first quarter 2025 results after markets close today, April 22, 2025.

At 4:30 p.m. Central Time / 5:30 p.m. Eastern Time, executives such as CEO Elon Musk will also be holding a Company Update and the Q1 2025 earnings call.

Tesla Q1 Deliveries and Production

Tesla missed estimates in the first quarter, with the company delivering a total of 336,681 vehicles worldwide. A total of 362,615 vehicles were also produced during this period.

While the delivery results of Tesla’s electric vehicle business were subpar in Q1 2025, the company’s energy division exhibited strong performance during the quarter, deploying a total of 10.4 GWh worth of energy storage products.

Earnings Estimates

As noted in a Forbes report, expectations are high that Tesla will report a gain of $0.35/share on $21.85 billion in revenue. Whisper numbers, however, reportedly suggest that the electric vehicle maker will only post a gain of $0.31 per share.

Analysts polled by FactSet, however, expect Tesla to see an EPS of $0.41 per share on revenues of $21.27 billion, as noted in an Investors’ Business Daily report.

Tesla Stock So Far

Tesla stock reached as high as $488.54 per share in 2024, though it is trading at around $240 per share as of writing. Tesla stock has been naturally volatile, however, so it is prone to notable moves depending on its Q1 earnings.

If the numbers are good, Tesla stock could easily gap up, but if they are disappointing, it would not be surprising if TSLA shares gap down.

FSD, New Vehicle Updates

Tesla is expected to launch a dedicated robotaxi service this June in Austin, Texas. The company has also been hinting at more affordable models that will be launched in the first half of 2025. Expectations are high that CEO Elon Musk will share some updates on these projects, particularly the rollout of Tesla’s FSD Unsupervised system.

-

News2 weeks ago

News2 weeks agoI took a Tesla new Model Y Demo Drive – Here’s what I learned

-

News2 weeks ago

News2 weeks agoTesla cleared of some claims in Blade Runner lawsuit

-

News2 weeks ago

News2 weeks agoTesla Supercharger in Washington bombed, police and FBI step in

-

Elon Musk5 days ago

Elon Musk5 days agoTesla doubles down on Robotaxi launch date, putting a big bet on its timeline

-

News1 week ago

News1 week agoTesla’s top investor questions ahead of the Q1 2025 earnings call

-

Investor's Corner2 weeks ago

Investor's Corner2 weeks agoTesla bull sees company’s future clearly: Cathie Wood

-

Cybertruck2 weeks ago

Cybertruck2 weeks agoTesla confirms Cybertruck will make its way out of North America this year

-

News2 weeks ago

News2 weeks agoTesla might benefit from Trump’s plans for Saudi Arabia