Investor's Corner

Tesla Gigafactory will host ‘investor event’ on Jan. 4, same week as CES 2017

As big names in consumer electronics and automakers gear up to debut their self-driving technology at next week’s CES 2017 from Las Vegas, Tesla is preparing for an event of its own just a few hundred miles away at the Gigafactory battery plant in Sparks, Nevada.

Tesla will be holding an invite-only “investor event” on January 4 at the Gigafactory where CEO Elon Musk and CTO JB Straubel will be on site and made available to analysts attending the exclusive event. “Everyone is converging in Nevada for CES, which starts the next day. There have been tons of requests for Gigafactory tours.” said Dougherty & Co. analyst Charlie Anderson who plans on attending the investor event, according to Bloomberg. The event is seen as a strategic move by Tesla that’s aimed at putting the company in good graces with analysts and investors, ahead of plans to spend heavily and reach a production level of 500,000 vehicles annually by 2018. A regulatory filing on December 21 revealed that Tesla increased its borrowing capacity by approximately $500 million under two new credit agreements. Tesla added $200 million to an existing line of credit with Deutsche Bank, bringing total borrowings to $1.2 billion, and doubled the size of a separate credit agreement from $300 million to $600 million.

Tesla has been been accelerating construction on the $5 billion Gigafactory 1 battery facility at an extremely fast pace. Earlier this month, a drone video captured amazing progress at the Gigafactory showing that new sections flanking each end of the main building have been completed, effectively doubling the size of the massive lithium-ion plant. Construction permits filed by Tesla reveal that a ‘2170 module line’ project – 2170 is the form factor for the company’s newest high energy density battery cells which will be used in Tesla’s mass market Model 3 – was underway during the second half of this year. The 2170 battery cell format is already being produced in conjunction with strategic partner Panasonic and being used in Tesla’s Powerwall and Powerpack battery storage products.

By 2018, Tesla plans to produce more lithium ion batteries annually than were produced worldwide in 2013. Tesla CEO Elon Musk characterized future production at the Gigafactory, during an investors call last year, as battery cells being fired through a machine gun. “the exit rate of cells will be faster than bullets from a machine gun.” said Musk.

Investor's Corner

Tesla “best positioned” for Trump tariffs among automakers: analyst

Ives has a price target of $315 per share for the electric vehicle maker.

Wedbush analyst Dan Ives recently shared his thoughts about Tesla (NASDAQ:TSLA) amidst the Trump administration’s tariffs. As per Ives, Tesla is best-positioned relative to its rivals when it comes to the ongoing tariff issue.

Ives has a price target of $315 per share for the electric vehicle maker.

Best Positioned

During an interview with Yahoo Finance, the segment’s hosts asked about his thoughts on Tesla, especially considering Musk’s work with the Trump administration. Musk has previously stated that the effects of tariffs on Tesla are significant due to parts that are imported from abroad.

“When it comes to the tariff issue, they are actually best positioned relative to the Detroit Big Three and others and obviously foreign automakers. Still impacted, Musk has talked about that, in terms of just auto parts,” Ives stated.

China and Musk

Ives also stated that ultimately, a big factor for Tesla in the coming months may be the Chinese market’s reactions to its tariff war. He also noted that the next few quarters will be pivotal for Tesla considering the brand damage that Elon Musk has incited due to his politics and work with the Trump administration.

“When it comes to Tesla, I think the worry is where does retaliatory look like in China, in terms of buying domestic. I think that’s something that’s a play. And they have a pivotal six months head, in terms of what everything we see in Austin, autonomous, and the buildout.

“But the brand issues that Musk self-inflicted is dealing with in terms of demand destruction in Europe and the US. And that’s why this is a key few quarters ahead for Tesla and also for Musk to make, in my opinion, the right decision to take a step back from the administration,” Ives noted.

Investor's Corner

Tesla negativity “priced into the stock at its current levels:” CFRA analyst

The CFRA analyst has given Tesla a price target of $360 per share.

In recent comments to the Schwab Network, CFRA analyst Garrett Nelson stated that a lot of the “negative sentiment towards Tesla (NASDAQ:TSLA) is priced into the stock at its current levels.”

The CFRA analyst has given Tesla a price target of $360 per share.

Q1 A Low Point in Sales

The CFRA analyst stated that Tesla’s auto sales likely bottomed last quarter, as noted in an Insider Monkey report. This was, Nelson noted, due to Q1 typically being the “weakest quarter for automakers.” He also highlighted that all four of Tesla’s vehicle factories across the globe were idled in the first quarter.

While Nelson highlighted the company’s changeover to the new Model Y as a factor in Q1, he also acknowledged the effects of CEO Elon Musk’s politics. The analyst noted that while Tesla lost customers due to Musk’s political opinions, the electric vehicle maker has also gained some new customers in the process.

CFRA’s Optimistic Stance

Nelson also highlighted that Tesla’s battery storage business has been growing steadily over the years, ending its second-best quarter in Q1 2025. The analyst noted that Tesla Energy has higher margins than the company’s electric vehicle business, and Tesla itself has a very strong balance sheet.

The CFRA analyst also predicted that Tesla could gain market share in the United States because it has less exposure to the Trump administration’s tariffs. Teslas are the most American-made vehicles in the country, so the Trump tariffs’ effects on the company will likely be less notable compared to other automakers that produce their cars abroad.

Investor's Corner

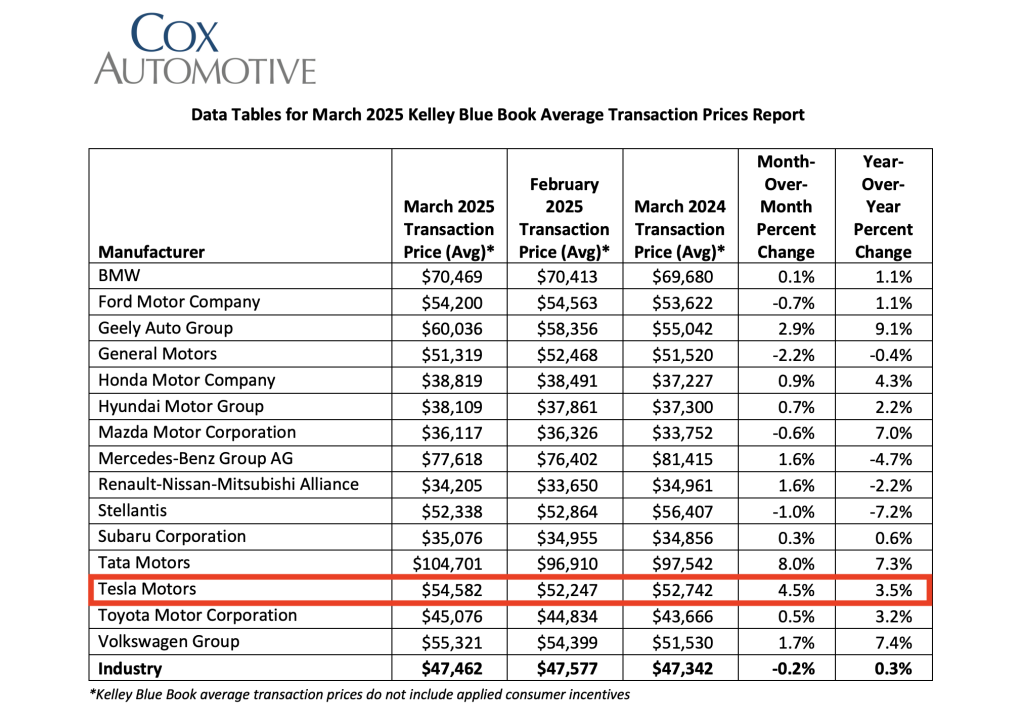

Tesla average transaction prices (ATP) rise in March 2025: Cox Automotive

Tesla Model Y and Model 3 saw an increase in their average transaction price (ATP) in March 2025.

Data recently released from Cox Automotive’s Kelley Blue Book has revealed that electric vehicles such as the Tesla Model Y and Model 3 saw an increase in their average transaction price (ATP) in March 2025.

Cox Automotive’s findings were shared in a press release.

March 2025 EV ATPs

As noted by Cox, new electric vehicle prices in March were estimated to be $59,205, a 7% increase year-over-year. In February, new EV prices had an ATP of $57,015. The average transaction price for electric vehicles was 24.7% higher than the overall auto industry ATP of $47,462.

As per Cox, “Compared to the overall industry ATP ($47,462), EV ATPs in March were higher by nearly 25% as the gap between new ICE and new EV grows wider. EV incentives continued to range far above the industry average. In March, the average incentive package for an EV was 13.3% of ATP, down from the revised 14.3% in February.”

Tesla ATPs in Focus

While Tesla saw challenges in the first quarter due to its factories’ changeover to the new Model Y, the company’s ATPs last month were estimated at $54,582, a year-over-year increase of 3.5% and a month-over-month increase of 4.5%. A potential factor in this could be the rollout of the Tesla Model Y Launch Series, a fully loaded, limited-edition variant of the revamped all-electric crossover that costs just under $60,000.

This increase, Cox noted, was evident in Tesla’s two best-selling vehicles, the Model 3 sedan and the Model Y crossover, the best-selling car globally in 2023 and 2024. “ATPs for Tesla’s two core models – Model 3 and Model Y – were higher month over month and year over year in March,” Cox wrote.

Cox’s Other Findings

Beyond electric vehicles, Cox also estimated that new vehicle ATPs held steady month-over-month and year-over-year in March at $47,462, down slightly from the revised-lower ATP of $47,577 in February. Sales incentives in March were flat compared to February at 7% of ATP, though they are 5% higher than 2024, when incentives were equal to 6.7% of ATP.

Estimates also suggest that new vehicle sales in March topped 1.59 million units, the best volume month in almost four years. This was likely due to consumers purchasing cars before the Trump administration’s tariffs took effect. As per Erin Keating, an executive analyst at Cox, all things are pointing to higher vehicle prices this summer.

“All signs point to higher prices this summer, as existing ‘pre-tariff’ inventory is sold down to be eventually replaced with ‘tariffed’ inventory. How high prices rise for consumers is still very much to be determined, as each automaker will handle the price puzzle differently. Should the White House posture hold, our team is expecting new vehicles directly impacted by the 25% tariff to see price increases in the range of 10-15%,” Keating stated.

-

News2 weeks ago

News2 weeks agoTesla celebrates key milestone for 4680 battery cell production cost

-

News2 weeks ago

News2 weeks agoI took a Tesla new Model Y Demo Drive – Here’s what I learned

-

News2 weeks ago

News2 weeks agoTesla Europe shares FSD test video weeks ahead of launch target

-

News2 weeks ago

News2 weeks agoTesla’s Giga Texas vehicles now drive themselves to outbound lot

-

News2 weeks ago

News2 weeks agoTesla’s ecological paradise near Giga Texas takes shape

-

News2 weeks ago

News2 weeks agoElon Musk and top Trump trade advisor Peter Navarro lock horns over tariffs

-

News2 weeks ago

News2 weeks agoTesla bull lowers price target citing ‘brand crisis’

-

News2 weeks ago

News2 weeks agoTesla adding new safety features for improved emergency detection