Investor's Corner

Tesla Destination Charging to the Rescue in China

Another big week is on deck for Tesla, the automaker and energy company release its first quarter 2015 earnings this week and that could include updates on China developments. Coming into 2015, the automaker’s woes in China were very apparent, with the firing of Veronica Wu and other PR personnel.

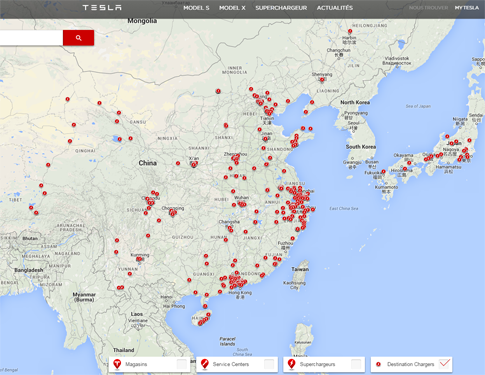

The Tesla map show includes just destination charging in Asia, excluding supercharging infrastructure.

The conventional wisdom for the firings centered around the lack of a singular message about Tesla charging infrastructure in the mainland. In a short matter of time, Tesla is changing that perception as a look at a recent charging map shows an impressive number of destination chargers in Asia, above top. The picture, above, depicts just destination chargers.

Tesla has recently emphasized destination charging for Europe for the 2nd quarter of 2015, but now we know they were quite busy in Asia and China in the 1st quarter. Capital expenditures may be at an all-time high this quarter as the company tries to regain momentum in Asia.

Recently, Tesla has created China momentum:

- Tesla says buyers in China’s Shenzhen can get special licenses: The city offers a limited number of license plates for new energy vehicles and Tesla was included in late March. The southern city borders Hong Kong and releases 20,000 licenses annually.

- In late April, Wuhan Tricycle Automobile Co., Ltd placed an order for 90 Teslas that will give the company a total of 100 Model S electric cars in their fleet. The company has a total of 1,100 cabs on the road in Wuhan, a small China city.

However, the lack of charging narrative is still out there via a “hard-hitting” Forbes post about how ONE customer that sold his Model S due to the lack of charging infrastructure at his complex (home). The guy is a “sorta of a big deal” and his name is Fan Xiabo, an advertising entrepreneur in China.

According to Forbes, the building management at his home said no to a home charger and he eventually sold the Model S for a third of what it’s worth.

I’m thinking he might have looked into that tiny detail before buying a $118,000 car in China. As content marketing entrepreneur, myself, I looked into the charging issue before I made my Model S purchase. Maybe Forbes can do a story on me.

Tesla has many substantial challenges in China. According to the Tesla forum, many upper-end car owners are chauffeured during the week and desire luxury treatment in the back seat. The first edition of Model S cars didn’t have executive rear seats, now that’s been an option since December 2014.

So will Musk and company be able to change the electric car charging narrative for China? See the map below that includes superchargers and destination chargers, you decide?

Investor's Corner

Tesla negativity “priced into the stock at its current levels:” CFRA analyst

The CFRA analyst has given Tesla a price target of $360 per share.

In recent comments to the Schwab Network, CFRA analyst Garrett Nelson stated that a lot of the “negative sentiment towards Tesla (NASDAQ:TSLA) is priced into the stock at its current levels.”

The CFRA analyst has given Tesla a price target of $360 per share.

Q1 A Low Point in Sales

The CFRA analyst stated that Tesla’s auto sales likely bottomed last quarter, as noted in an Insider Monkey report. This was, Nelson noted, due to Q1 typically being the “weakest quarter for automakers.” He also highlighted that all four of Tesla’s vehicle factories across the globe were idled in the first quarter.

While Nelson highlighted the company’s changeover to the new Model Y as a factor in Q1, he also acknowledged the effects of CEO Elon Musk’s politics. The analyst noted that while Tesla lost customers due to Musk’s political opinions, the electric vehicle maker has also gained some new customers in the process.

CFRA’s Optimistic Stance

Nelson also highlighted that Tesla’s battery storage business has been growing steadily over the years, ending its second-best quarter in Q1 2025. The analyst noted that Tesla Energy has higher margins than the company’s electric vehicle business, and Tesla itself has a very strong balance sheet.

The CFRA analyst also predicted that Tesla could gain market share in the United States because it has less exposure to the Trump administration’s tariffs. Teslas are the most American-made vehicles in the country, so the Trump tariffs’ effects on the company will likely be less notable compared to other automakers that produce their cars abroad.

Investor's Corner

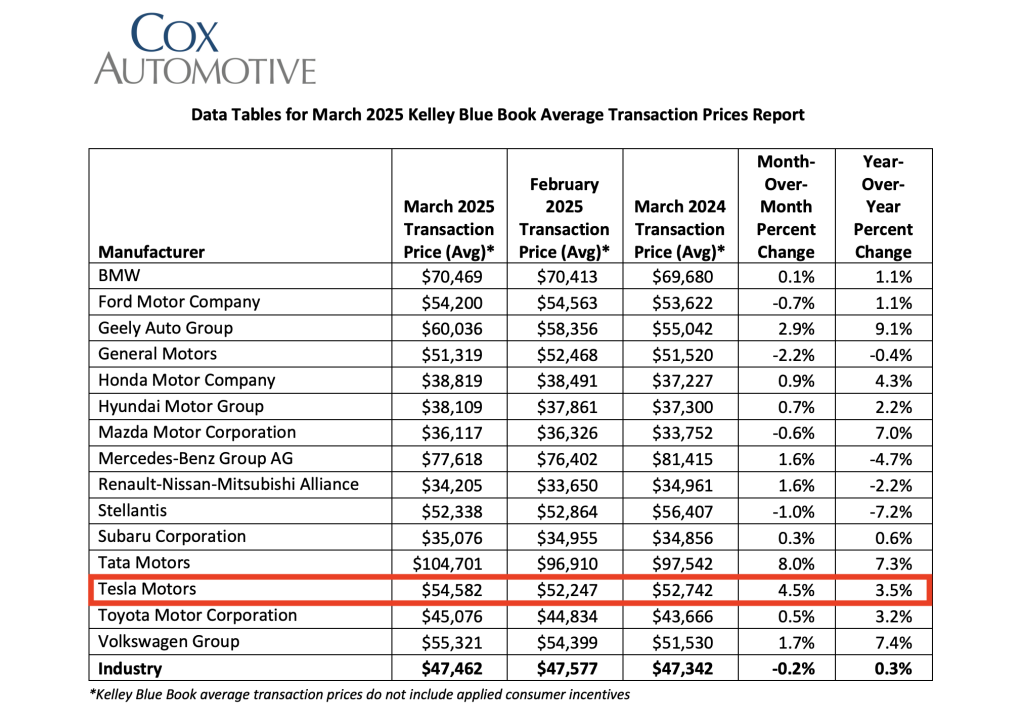

Tesla average transaction prices (ATP) rise in March 2025: Cox Automotive

Tesla Model Y and Model 3 saw an increase in their average transaction price (ATP) in March 2025.

Data recently released from Cox Automotive’s Kelley Blue Book has revealed that electric vehicles such as the Tesla Model Y and Model 3 saw an increase in their average transaction price (ATP) in March 2025.

Cox Automotive’s findings were shared in a press release.

March 2025 EV ATPs

As noted by Cox, new electric vehicle prices in March were estimated to be $59,205, a 7% increase year-over-year. In February, new EV prices had an ATP of $57,015. The average transaction price for electric vehicles was 24.7% higher than the overall auto industry ATP of $47,462.

As per Cox, “Compared to the overall industry ATP ($47,462), EV ATPs in March were higher by nearly 25% as the gap between new ICE and new EV grows wider. EV incentives continued to range far above the industry average. In March, the average incentive package for an EV was 13.3% of ATP, down from the revised 14.3% in February.”

Tesla ATPs in Focus

While Tesla saw challenges in the first quarter due to its factories’ changeover to the new Model Y, the company’s ATPs last month were estimated at $54,582, a year-over-year increase of 3.5% and a month-over-month increase of 4.5%. A potential factor in this could be the rollout of the Tesla Model Y Launch Series, a fully loaded, limited-edition variant of the revamped all-electric crossover that costs just under $60,000.

This increase, Cox noted, was evident in Tesla’s two best-selling vehicles, the Model 3 sedan and the Model Y crossover, the best-selling car globally in 2023 and 2024. “ATPs for Tesla’s two core models – Model 3 and Model Y – were higher month over month and year over year in March,” Cox wrote.

Cox’s Other Findings

Beyond electric vehicles, Cox also estimated that new vehicle ATPs held steady month-over-month and year-over-year in March at $47,462, down slightly from the revised-lower ATP of $47,577 in February. Sales incentives in March were flat compared to February at 7% of ATP, though they are 5% higher than 2024, when incentives were equal to 6.7% of ATP.

Estimates also suggest that new vehicle sales in March topped 1.59 million units, the best volume month in almost four years. This was likely due to consumers purchasing cars before the Trump administration’s tariffs took effect. As per Erin Keating, an executive analyst at Cox, all things are pointing to higher vehicle prices this summer.

“All signs point to higher prices this summer, as existing ‘pre-tariff’ inventory is sold down to be eventually replaced with ‘tariffed’ inventory. How high prices rise for consumers is still very much to be determined, as each automaker will handle the price puzzle differently. Should the White House posture hold, our team is expecting new vehicles directly impacted by the 25% tariff to see price increases in the range of 10-15%,” Keating stated.

Investor's Corner

Tesla bull sees company’s future clearly: Cathie Wood

ARK Invest’s Cathie Wood remains bullish as TSLA rebounds. Trump tariffs loom, but Wood says Tesla’s U.S. supply chain gives it an edge.

ARK Invest’s Cathie Wood explained her bullish stance on Tesla once again. Tesla shares dropped after a challenging first quarter. However, TSLA stock surged on Wednesday, proving Wood’s optimism was right on the money.

In an interview with Barron’s, Wood enumerated a few reasons ARK Invest sees a bright future for Tesla. She predicts that Tesla will launch a cheaper electric vehicle (EV), starting at around $30,000—half the price of a typical Model Y. “This will help bring affordability back into auto buying,” Wood said.

Tesla’s $30,000 EV model is expected to launch this quarter. However, Tesla is already refreshing its EV lineup and offering cheaper models. It debuted a Long Range All-Wheel-Drive Model Y “Juniper” in the U.S. on April 4, priced at $48,990 before a $7,500 tax credit.

Wood also touted Tesla’s upcoming robotaxi service, which she predicts will help consumers save upfront costs that would usually go to buying a new car. The ARK Invest CEO argues that Tesla’s robotaxi service would be cheaper than Uber and Lyft because it would save costs without a human driver.

Benchmark analyst Mickey Legg echoed Wood’s prediction in a recent note. Legg believes the negative narrative surrounding Tesla is exaggerated. The Benchmark analyst encouraged investors to look at the catalysts that could drive TSLA stocks up, like its AI developments.

Similar to Legg, Wood brushed off concerns about Elon Musk’s ties to Trump and negativity surrounding Tesla stock. “News cycles pass quickly nowadays, and the best cars are going to win.”

The ARK Invest CEO also shared her thoughts on Trump’s tariffs and how they would affect companies like Tesla.

“When businesses and consumers are scared, they’ll change the way they do things, and that’s usually good for the companies that are helping others do things better, cheaper, faster, more creatively, and more productively,” she said.

Wood noted that Tesla’s heavy North American sourcing will soften tariff blows. With affordability and tech in focus, Wood sees Tesla forging ahead despite Trump’s tariffs.

-

News1 week ago

News1 week agoTesla rolls out new, more affordable trim of the Model Y Juniper in U.S.

-

News2 weeks ago

News2 weeks agoTesla shares Optimus’ improved walk in new update video

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla Germany reports 4,935 units sold in Q1 2025

-

Investor's Corner2 weeks ago

Investor's Corner2 weeks agoTesla (TSLA) shares company-compiled Q1 2025 delivery consensus

-

News1 week ago

News1 week agoTesla expands Early Access Program (EAP) for early Full Self-Driving testing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoNYC Comptroller moves to sue Tesla for securities violations

-

News1 week ago

News1 week agoTesla celebrates key milestone for 4680 battery cell production cost

-

News2 weeks ago

News2 weeks agoTesla’s Elon Musk reiterates ambitious Cybertruck water update