Investor's Corner

Tesla beats Wall St. estimates: $7 billion revenue; record Model S, X orders; Model 3 production starts in July

Tesla released its fourth quarter 2016 earnings after the closing bell on Wednesday, summarized in the Q4’16 Update Letter, surprising Wall Street after posting fourth quarter earnings loss of 69 cents a share, at the low end of the estimated analyst losses. Revenue was $2.28 billion versus an estimate of $2.13 billion.

The complete text of the Tesla Fourth Quarter 2016 Update letter can be seen at the end of this article. We’ve embedded a copy of the original document from Tesla.

Revenue

In the letter, Tesla announced that “2016 revenue of $7 billion, up 73% from 2015.”

This is the first time Tesla reported earnings since the company’s acquisition of SolarCity Corp. in mid-November. Tesla had done little to guide the market for how to expect results, leading some analysts to exclude the solar panel business from their estimates until greater clarity is provided. As a result, the estimates between analysts varied widely. Some were expecting the company to report a loss of as low as $0.43 per share on revenues of $2.18 billion for the December quarter. Other analysts were expecting a loss of as much as $1.19 a share. According to a consensus poll with analysts conducted by FactSet, Tesla was expected to report an adjusted fourth-quarter loss of 53 cents per share. Expectations varied greatly.

Model 3

In the letter, Tesla announced that “Model 3 on track for initial production in July, volume production by September” and reiterated that “the Model 3 and solar roof launches are on track for the second half of the year.”

The company also reported record high orders in Q4 for its Model S and X vehicles.

Elon has set a July 1 deadline for his suppliers and internal teams to be ready for production. Investors will be listening for additional information about the status of the Model 3 during the conference call scheduled for 2:30 pm PT today.

An update on the Model 3 is highly anticipated. With Elon Musk’s goal of manufacturing and selling 100,000 to 200,000 Model 3’s in the second half of 2017, and half a million cars per year by 2018, this is a major driver for the stock. Since the company ended 2016 producing 83,922 cars, or roughly 230 cars per day, ramping up production sixfold will require new investments in equipment, people and facilities.

Guidance for 2017

In the letter, Tesla states that “We expect to deliver 47,000 to 50,000 Model S and Model X vehicles combined in the first half of 2017, representing vehicle delivery growth of 61% to 71% compared with the same period last year. In addition, both GAAP and non-GAAP automotive gross margin should recover in Q1 to Q3 2016 levels and then continue to expand in Q2 2017.”

Elon Musk has a history of setting ambitious targets and missing deadlines. Jeffrey Osborn, an analyst for Cowen and Co., wondered if the influence of Chief Financial Officer Jason Wheeler, after about 18 months into his job since coming from Alphabet Inc., would have been seen in setting more conservative 2017’s targets.

SolarCity

In the letter, Tesla announced that “SolarCity and Grohmann integrations underway.”

Elon Musk also faces the challenge of integrating SolarCity into Tesla. He dropped the word “Motors” from the company’s name earlier this month as he looks to make a fully integrated company that makes solar powers to generate energy, large batteries for storing that power at home and offices and electric cars that can run on it. Since the deal closed on Nov. 21, Tesla shares have risen almost 50%.

The quarter’s results include just over a month of the SolarCity merger. It may be difficult to determine how much it impacted Tesla’s numbers unless management provides specific information on SolarCity. March quarter’s guidance will be even more important than usual since it will include a full quarter of SolarCity’s business. Watch for some of these issues to be discussed in the Conference Call Q&A.

Cash

In the letter, Tesla announced that “Q3 to Q4 cash increased by over $300 million to $3.4 billion. In Q4, we increased cash by $309 million.”

One of the big issues against the SolarCity deal was the effect it would have on Tesla’s cash pile just as it prepares to introduce the Model 3. Mr. Musk has said he has enough money, though signaled he might raise additional cash through the capital or debt markets. Tesla’s guidance in October suggested it planned to spend about $1 billion on capital expenditures in the fourth quarter. Tesla finished September with $3.1 billion in cash.

TSLA Stock

Tesla shares have been on a tear, up 53%to $277.39 since December 2 when they closed at $181.47. From a technical perspective the shares had created a double bottom when combined with the low from November 14 of $181.45. The 53% increase has led to the stock being overbought but the shares have been overbought since the beginning of the year when they were trading at $214. The shares are also 18% above their 50 day moving average and 29% above the 200 day moving average. All of these are bullish indicators, closely followed by technical investors and traders.

The previous time the shares were this far above its moving averages was back in 2014. While it may only be short-term the stock is more likely to move down vs. up after today’s earnings announcement.

Today’s session ended up closing 1.4% lower, with some traders not wanting to risk the huge gains over a Quarterly report. Looking at the extended trading action after the close, the initial reaction to the numbers for Q4 2016 is hugely positive, with the stock raising to $280 just 1 minute after the close and continuing into the session. Expect a positive opening on Thursday.

[pdf-embedder url=”http://www.teslarati.com/wp-content/uploads/2017/02/TSLA_Update_Letter_2016-4Q.pdf”]

Investor's Corner

Tesla negativity “priced into the stock at its current levels:” CFRA analyst

The CFRA analyst has given Tesla a price target of $360 per share.

In recent comments to the Schwab Network, CFRA analyst Garrett Nelson stated that a lot of the “negative sentiment towards Tesla (NASDAQ:TSLA) is priced into the stock at its current levels.”

The CFRA analyst has given Tesla a price target of $360 per share.

Q1 A Low Point in Sales

The CFRA analyst stated that Tesla’s auto sales likely bottomed last quarter, as noted in an Insider Monkey report. This was, Nelson noted, due to Q1 typically being the “weakest quarter for automakers.” He also highlighted that all four of Tesla’s vehicle factories across the globe were idled in the first quarter.

While Nelson highlighted the company’s changeover to the new Model Y as a factor in Q1, he also acknowledged the effects of CEO Elon Musk’s politics. The analyst noted that while Tesla lost customers due to Musk’s political opinions, the electric vehicle maker has also gained some new customers in the process.

CFRA’s Optimistic Stance

Nelson also highlighted that Tesla’s battery storage business has been growing steadily over the years, ending its second-best quarter in Q1 2025. The analyst noted that Tesla Energy has higher margins than the company’s electric vehicle business, and Tesla itself has a very strong balance sheet.

The CFRA analyst also predicted that Tesla could gain market share in the United States because it has less exposure to the Trump administration’s tariffs. Teslas are the most American-made vehicles in the country, so the Trump tariffs’ effects on the company will likely be less notable compared to other automakers that produce their cars abroad.

Investor's Corner

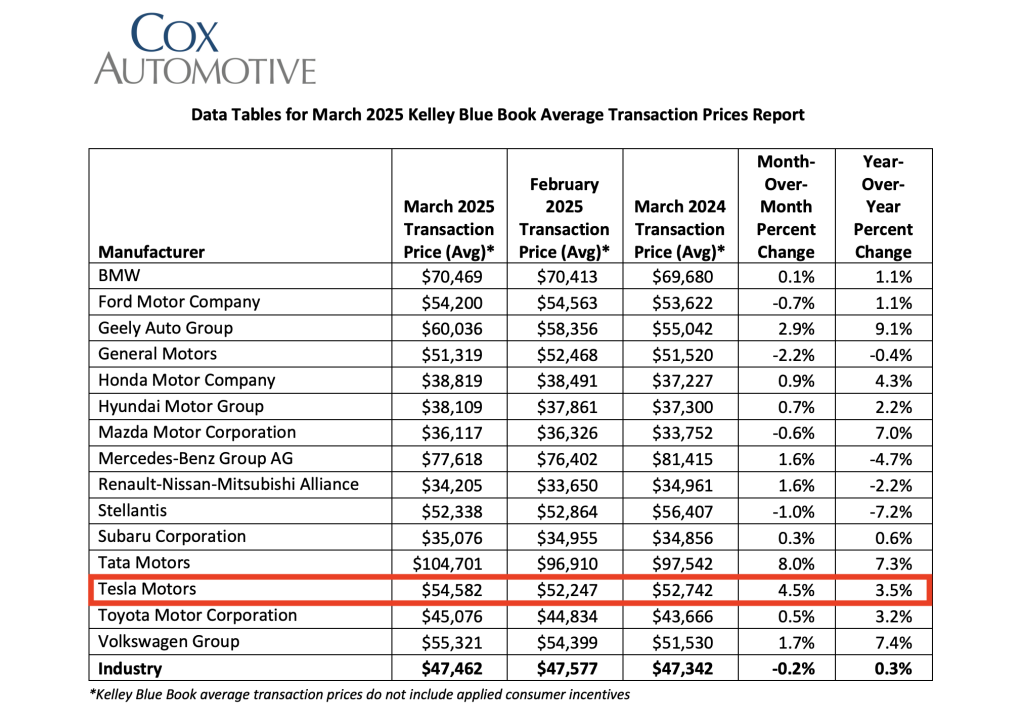

Tesla average transaction prices (ATP) rise in March 2025: Cox Automotive

Tesla Model Y and Model 3 saw an increase in their average transaction price (ATP) in March 2025.

Data recently released from Cox Automotive’s Kelley Blue Book has revealed that electric vehicles such as the Tesla Model Y and Model 3 saw an increase in their average transaction price (ATP) in March 2025.

Cox Automotive’s findings were shared in a press release.

March 2025 EV ATPs

As noted by Cox, new electric vehicle prices in March were estimated to be $59,205, a 7% increase year-over-year. In February, new EV prices had an ATP of $57,015. The average transaction price for electric vehicles was 24.7% higher than the overall auto industry ATP of $47,462.

As per Cox, “Compared to the overall industry ATP ($47,462), EV ATPs in March were higher by nearly 25% as the gap between new ICE and new EV grows wider. EV incentives continued to range far above the industry average. In March, the average incentive package for an EV was 13.3% of ATP, down from the revised 14.3% in February.”

Tesla ATPs in Focus

While Tesla saw challenges in the first quarter due to its factories’ changeover to the new Model Y, the company’s ATPs last month were estimated at $54,582, a year-over-year increase of 3.5% and a month-over-month increase of 4.5%. A potential factor in this could be the rollout of the Tesla Model Y Launch Series, a fully loaded, limited-edition variant of the revamped all-electric crossover that costs just under $60,000.

This increase, Cox noted, was evident in Tesla’s two best-selling vehicles, the Model 3 sedan and the Model Y crossover, the best-selling car globally in 2023 and 2024. “ATPs for Tesla’s two core models – Model 3 and Model Y – were higher month over month and year over year in March,” Cox wrote.

Cox’s Other Findings

Beyond electric vehicles, Cox also estimated that new vehicle ATPs held steady month-over-month and year-over-year in March at $47,462, down slightly from the revised-lower ATP of $47,577 in February. Sales incentives in March were flat compared to February at 7% of ATP, though they are 5% higher than 2024, when incentives were equal to 6.7% of ATP.

Estimates also suggest that new vehicle sales in March topped 1.59 million units, the best volume month in almost four years. This was likely due to consumers purchasing cars before the Trump administration’s tariffs took effect. As per Erin Keating, an executive analyst at Cox, all things are pointing to higher vehicle prices this summer.

“All signs point to higher prices this summer, as existing ‘pre-tariff’ inventory is sold down to be eventually replaced with ‘tariffed’ inventory. How high prices rise for consumers is still very much to be determined, as each automaker will handle the price puzzle differently. Should the White House posture hold, our team is expecting new vehicles directly impacted by the 25% tariff to see price increases in the range of 10-15%,” Keating stated.

Investor's Corner

Tesla bull sees company’s future clearly: Cathie Wood

ARK Invest’s Cathie Wood remains bullish as TSLA rebounds. Trump tariffs loom, but Wood says Tesla’s U.S. supply chain gives it an edge.

ARK Invest’s Cathie Wood explained her bullish stance on Tesla once again. Tesla shares dropped after a challenging first quarter. However, TSLA stock surged on Wednesday, proving Wood’s optimism was right on the money.

In an interview with Barron’s, Wood enumerated a few reasons ARK Invest sees a bright future for Tesla. She predicts that Tesla will launch a cheaper electric vehicle (EV), starting at around $30,000—half the price of a typical Model Y. “This will help bring affordability back into auto buying,” Wood said.

Tesla’s $30,000 EV model is expected to launch this quarter. However, Tesla is already refreshing its EV lineup and offering cheaper models. It debuted a Long Range All-Wheel-Drive Model Y “Juniper” in the U.S. on April 4, priced at $48,990 before a $7,500 tax credit.

Wood also touted Tesla’s upcoming robotaxi service, which she predicts will help consumers save upfront costs that would usually go to buying a new car. The ARK Invest CEO argues that Tesla’s robotaxi service would be cheaper than Uber and Lyft because it would save costs without a human driver.

Benchmark analyst Mickey Legg echoed Wood’s prediction in a recent note. Legg believes the negative narrative surrounding Tesla is exaggerated. The Benchmark analyst encouraged investors to look at the catalysts that could drive TSLA stocks up, like its AI developments.

Similar to Legg, Wood brushed off concerns about Elon Musk’s ties to Trump and negativity surrounding Tesla stock. “News cycles pass quickly nowadays, and the best cars are going to win.”

The ARK Invest CEO also shared her thoughts on Trump’s tariffs and how they would affect companies like Tesla.

“When businesses and consumers are scared, they’ll change the way they do things, and that’s usually good for the companies that are helping others do things better, cheaper, faster, more creatively, and more productively,” she said.

Wood noted that Tesla’s heavy North American sourcing will soften tariff blows. With affordability and tech in focus, Wood sees Tesla forging ahead despite Trump’s tariffs.

-

News1 week ago

News1 week agoTesla rolls out new, more affordable trim of the Model Y Juniper in U.S.

-

News1 week ago

News1 week agoTesla shares Optimus’ improved walk in new update video

-

News2 weeks ago

News2 weeks agoTesla US Gigafactories shields from Trump’s 25% Tariffs

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoMusk says xAI has acquired X in $33 billion stock deal

-

Elon Musk1 week ago

Elon Musk1 week agoTesla Germany reports 4,935 units sold in Q1 2025

-

Investor's Corner2 weeks ago

Investor's Corner2 weeks agoTesla (TSLA) shares company-compiled Q1 2025 delivery consensus

-

News1 week ago

News1 week agoTesla expands Early Access Program (EAP) for early Full Self-Driving testing

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoNYC Comptroller moves to sue Tesla for securities violations