News

Automakers come to accept that the EV revolution has begun

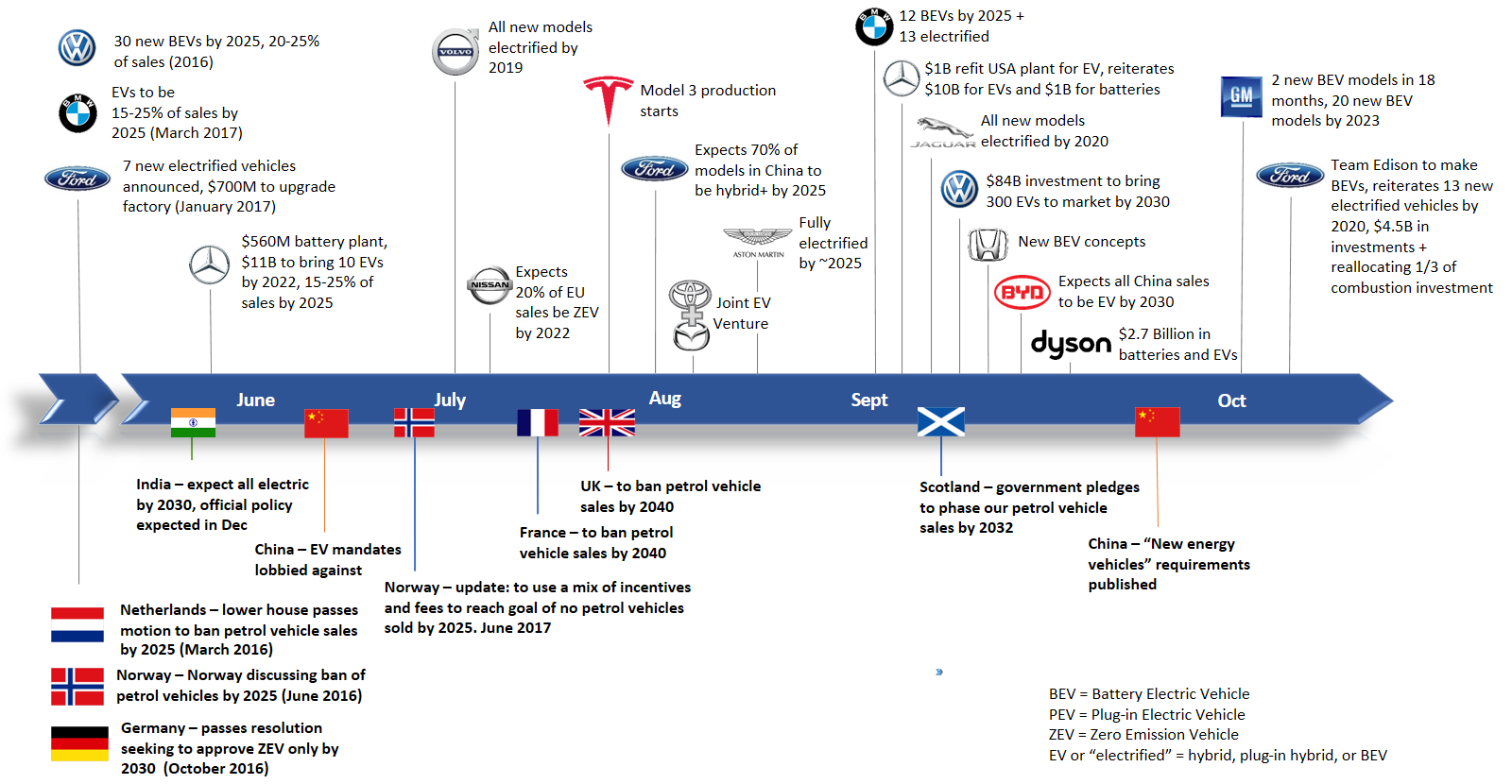

The last several months have been busy in the electric vehicle revolution. Governments have been announcing their phase out plans for petrol vehicles and automakers have committed billions of dollars to electrification programs. At this point automakers are practically falling over each other racing to get out their announcements. How many electric vehicles they’re developing, how much they’re investing, are they going fully electrified, and when. Suddenly no one wants to be perceived as falling behind in this revolution. And why should they? Nokia and Blackberry can attest to what happens if you do.

In the past, established automakers have been very cautious with electrification, with many simply watching to see how the situation developed. Generally, their investments could be best described as vague or immaterial to their core business of making cars. That’s clearly changed – take a look at the timeline of announcements below.

Taken as a whole these announcements are really quite striking. Most recently it was GM and Ford that released their competing declarations of electrification. GM with twenty new fully electric vehicles by 2023 and Ford quickly following up to say they had a new dedicated team for fully electric vehicles, while reiterating their previously committed $4.5 billion in investments for 13 new electrified vehicle options. Ford followed up the next day to say they were also diverting one third of their investments from combustion vehicle development.

The month prior was filled with even more announcements, including tweets between Elon Musk and Mercedes about the size of the latter’s investments. Volkswagen, BMW, Mercedes, Jaguar, Honda, BYD, and Dyson all made significant announcements about their EV programs that month, but it was Volvo’s “fully electrified” announcement that first caught the media’s attention back in July. It was a clever, if somewhat misleading PR move, but it did set important targets for their company and the competition. The fact that Tesla started producing their mass market Model 3 was almost lost amongst all this news. That’s an exaggeration of course, but only a year ago many believed their plans were impossible.

Government announcements have been another important part of the narrative, with targets that provide direction and impetus to the industry. Based on some of the lobbying it hasn’t been entirely welcome, but that’s to be expected. Anytime an entire country is talking about completely phasing out your current business model, it’s going give an industry pause. In this case there were multiple, with China, the UK, France, India, and several others weighing in with their plans to phase out combustion vehicles.

Looking at these announcements together suggests that a new phase in the electric vehicle revolution has begun. The fundamentals behind this shift are what I will argue here. My proposition is that the combined macro-economic drivers of regulation, competition, and market growth are pushing EVs to the mainstream. Be forewarned, it’s a long post, but analyzing any of these factors in isolation loses the bigger picture. Electric vehicles are coming, of that there can be no doubt.

Regulation, competition, and market growth.

You’ll notice the analysis below centers around plug-in electric vehicles (PEVs). Today a little more than 60% of new EV sales are pure battery electric vehicles (BEVs) and the rest are plug-in hybrid electric vehicles (PHEVs). PHEV’s are a transitionary technology, which currently offer some benefits that will disappear as battery costs continue to fall and range continues to increase. Note that the analysis doesn’t include hybrids without plugs, they’re old news. Also note that in talking about vehicles and vehicle sales, these are always in reference to passenger vehicles (i.e. no freight trucks). Annual passenger vehicles sales data was taken from the International Organization of Motor Vehicle Manufacturers and electric sales information is from the International Energy Agency.

Regulation:

The 2015 Paris climate agreement requires country specific greenhouse gas reductions by 2030 or sooner. As part of the agreement countries must also submit annual reports on their progress. Transport is a key part of each country’s emissions and it’s one that has a solution at hand, hence the plans to phase out combustion vehicles. France and UK announced for bans by 2040, Scotland by 2032, Netherlands 2025, Norway 2025, and India and China in development. There’s some subtlety to each. Norway for example is leaning towards economic levers to achieve their goals in lieu of outright restrictions, while India has said they expect all vehicles to be electric by 2030 without regulation being necessary, though their official policy is expected later this year.

Personally I tend to agree. I expect we will all be buying electric vehicles long before 2040 largely due to economics, especially with carbon pricing. That said, all of the government announcements are important. They provide both the public and automakers a framework in which to operate, while the more aggressive targets are actually moving the industry forward.

California and nine east coast states have long mandated a portion of sales be zero emission vehicles (ZEVs), administered through a credit system. The system gives partial credit to plug-in electric vehicles (PEVs) and more credits to long range zero emission vehicles (ZEVs). It’s basically the reason automakers have produced ZEVs in the USA. In quite possibly the biggest announcement of the year China is now doing something similar. They’ve mandated a ‘new energy vehicle’ credit requirement of 10% of sales in 2019 and 12% in 2020. Since one EV can be responsible for multiple credits it means that less than 12% of all vehicles sold will be required to be zero emission vehicles. For example, if the requirement was met with vehicles like the BMW i3, it would mean 4.6% of all vehicle sales in China would be ZEV in 2020, about 1.4 million that year. For reference there are about 2.5 million PEVs on the planet right now.

China is also looking at establishing a date for complete phase out of petrol vehicles, which has caught California’s attention. California is not eager to lose their leadership position in electric vehicles and is now looking to increase their own targets and establish their own timeline for complete phase out. I believe the quote from their governor was “Why haven’t we done something already?”. It seems that an EV target race has begun and that means mandated growth for the EV market.

source: BMW

Market Growth:

This one has always been a bit of ‘chicken or the egg’ scenario. Historically demand for electric vehicles was low, which automakers referenced as the reason for their limited offerings. Others argued that there could be no demand when so few options were available, especially when those that did exist had such weird aesthetics (which was an effective way to prevent scavenging from more profitable combustion sales). Tesla flipped this around with their preorders of the Model 3 and showed everyone the latent demand to the tune of nearly 400,000 preorders. Other automakers took notice. BMW even started having widespread video presentations depicting the threat of Tesla to motivate their employees.

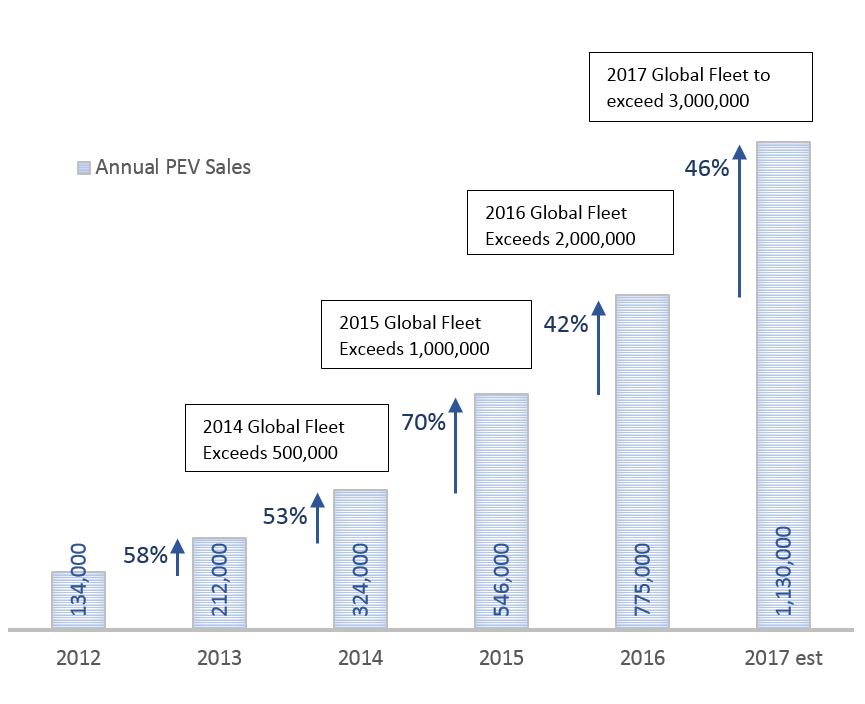

If you’ve only heard the rhetoric of how electric vehicles constitute a small fraction of the world’s annual sales, you might have missed something important. Exponential growth. Since 2012 growth of plug-in electric vehicles has been over 40% every year. Cumulatively that means 10x more PEVs will be sold in 2017 than 2012, as shown in the graph below.

Historical data from the IEA, 2017 estimate from EVvolumes.com

Don’t get me wrong, the existing market share is almost laughably low at 1.1% worldwide (2016 data from the IEA), but over the last three years sales have grown at an average 54.6% compound annual growth rate (CAGR).

To illustrate the effect of exponential growth consider the following example about bacteria in a jar. If the number of bacteria doubles every minute and after 1 hour the jar is full of bacteria, that means at 59 minutes the jar is half-full, at 58 minutes ¼ full, at 57 minutes 1/8 full, etc. At 54 minutes that jar is only 1.6% full and everyone is thinking that bacterial will never fill the jar. It’s simplistic and exaggerated but that’s where we are today, at 54 minutes.

The example shows the power of exponential growth but also the challenge in forecasting it. Over the long term, small changes in annual growth rates can have big impacts. Solar power projections were notoriously underestimated and each year forecasts had to be revised upwards. That’s not to disparage the forecasters, it’s incredibly difficult to do what they do and certainly some caution in forecasting is warranted. But it is worth considering that electric vehicles may be in a similar situation. For example, Bloomberg New Energy Finance (BNEF) posted an EV outlook report in 2016, estimating that annual sales in 2040 would be 35% of all vehicles sold and the total PEV fleet would be 410 million. This year they revised those projections up, to 54% and 600 million. That’s 200 million more EVs, on a starting estimate of 410 million, after one year of new data. Will the next years’ forecasts also be revised upwards?

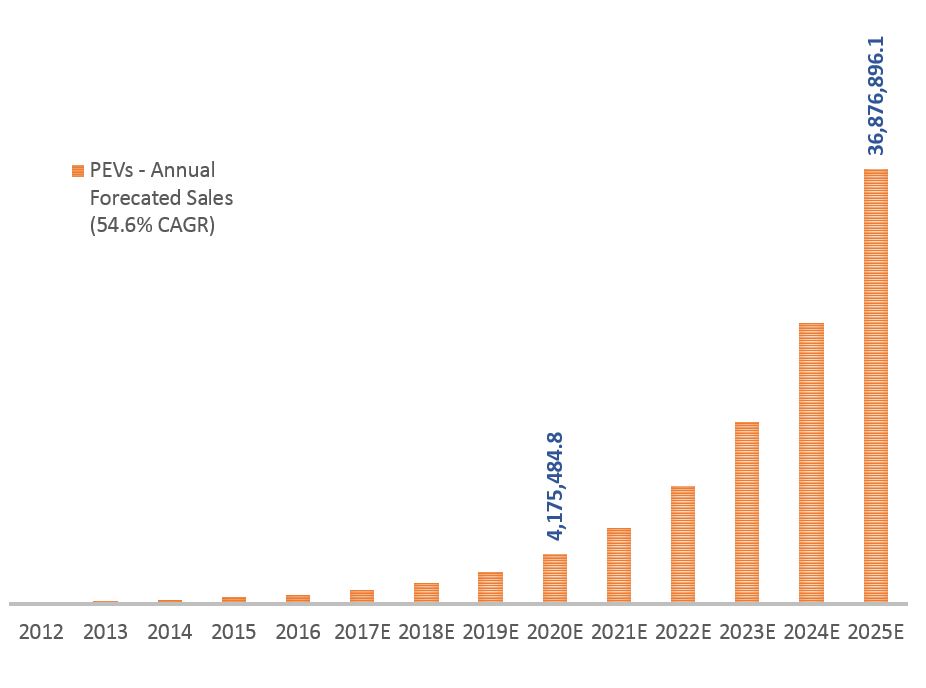

Shorter timeframes are usually more accurate, BNEF’s numbers indicate they expect approximately 2.5 million PEVs to be sold in 2020. That seems reasonable, but it would mean that PEV sales growth slows to 35% annually for the next few years. With more models coming that have better features and lower costs, and with governments now pushing the market with more aggressive targets, it seems unlikely growth will slow. So as an experiment what happens if the 54.6% growth rate over the last three years continues, to 2020 and 2025?

The impact would be impressive. The graph indicates that over 4 million PEVs would be sold in 2020, for 5% of total vehicle sales. That jumps to 37 million PEVs sold in 2025, nearly 40% of the total vehicle sales predicted. Contrast that with BNEF numbers, of 3% of sales in 2020 and 8% in 2025. Personally I think 8% is a low estimate for 2025, it works out to a compound annual growth rate of approximately 25%. Interestingly UBS increased their 2025 PEV estimate upwards by 50% this year (from 2016) to 14% of total sales – showing that short-term projections can be just as uncertain.

The impact would be impressive. The graph indicates that over 4 million PEVs would be sold in 2020, for 5% of total vehicle sales. That jumps to 37 million PEVs sold in 2025, nearly 40% of the total vehicle sales predicted. Contrast that with BNEF numbers, of 3% of sales in 2020 and 8% in 2025. Personally I think 8% is a low estimate for 2025, it works out to a compound annual growth rate of approximately 25%. Interestingly UBS increased their 2025 PEV estimate upwards by 50% this year (from 2016) to 14% of total sales – showing that short-term projections can be just as uncertain.

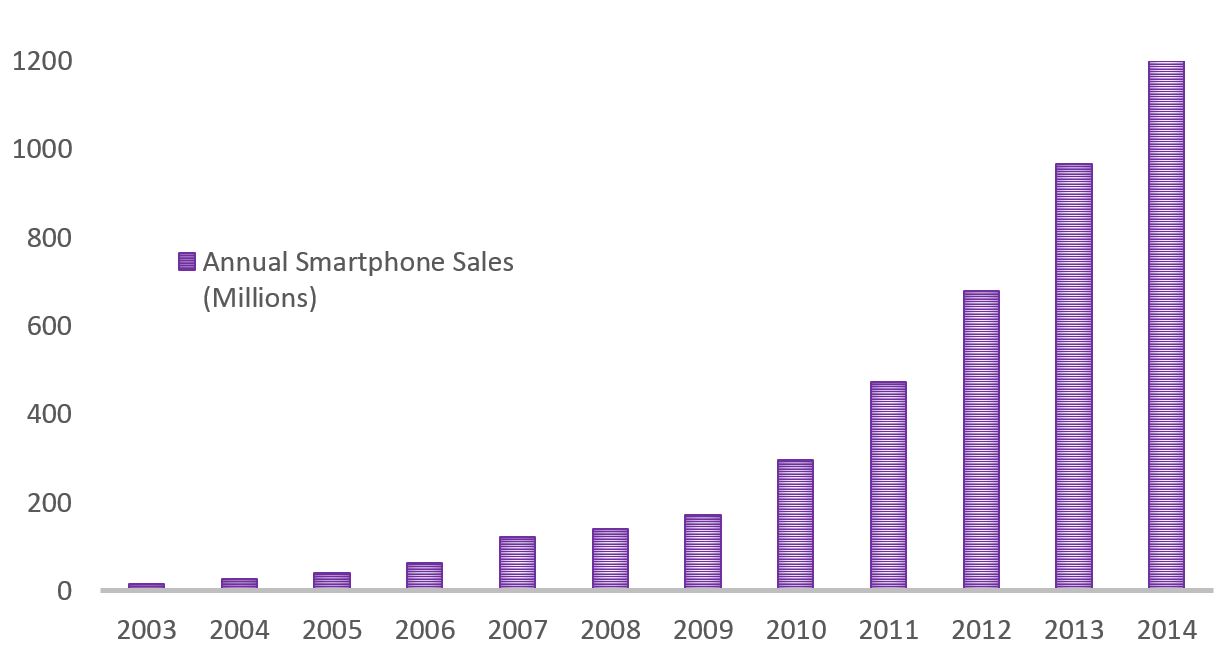

Perhaps 54.6% isn’t feasible, although Tesla has nearly managed it with a 47% growth rate since 2013. They did this while building up their staff, infrastructure, technology, and procedures virtually from scratch all at the same time. It’s also worth considering the history of smartphones. Globally smartphone sales grew at a rate of 46.4% year over year for ten years from 2004 to 2014, growing from sales of 27 million a year to over a billion. It was even more dramatic in China, where smartphone users accounted for about 5% of mobile subscribers in 2010 but were 70% by 2015 (Statista). That’s in just 5 years.

Data from www.gartner.com

Granted smartphones are not cars. The average smartphone costs orders or magnitude less and is traded in every two years, while the average car is traded in every 6.5 years (in the USA). A smartphone apparently has an average total lifespan of 4.7 years and a car can last to ~200,000 miles, approximately 15 years of average driving.

But electric cars do offer something cell phones never have. A lower cost. Cell phones provide a wealth of new functionality in our lives, but generally at a premium. Today, electric cars already cost less to operate than combustion vehicles, by 2018 they are expected to reach cost parity on total cost of ownership (UBS report), and by 2025 Bloomberg expects them to cost less upfront than combustion vehicles. That’s battery only electric vehicles (BEVs). Perhaps the changeover is longer than it was for cellphones, but once BEVs have an upfront cost less than petrol, why would anyone buy anything else?

Competition:

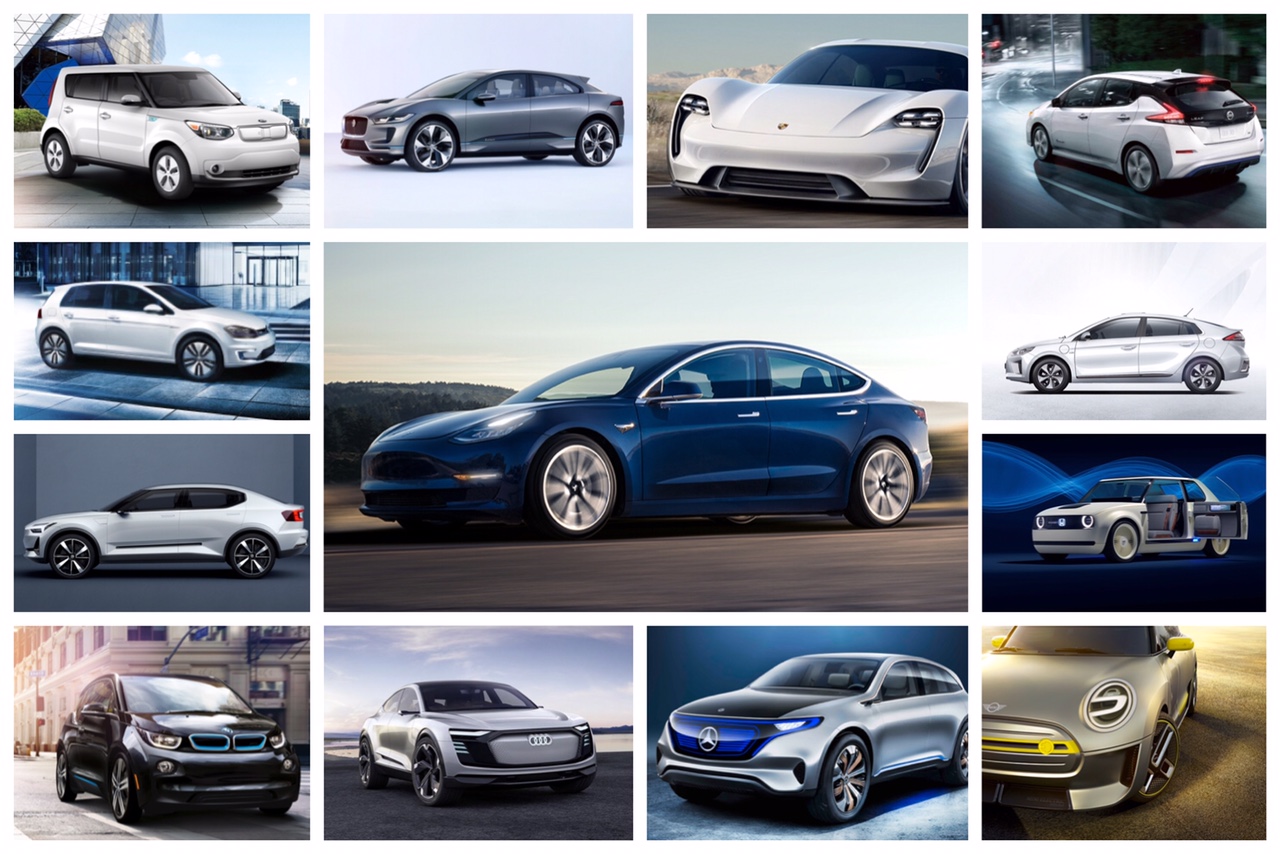

More and more manufacturers are entering the electric vehicle field with legitimate programs and their EVs are getting excellent reviews. At the end of 2016 the Chevy Bolt came out and won the North American and Motor Trend car of the year awards. Be prepared to see future EVs dominate the awards. VW already has a new e-Golf, Nissan a new Leaf, BMW an updated i3, Hyundai released their Ionic, and Audi, Porsche, and Jaguar are all coming out with pure EV models in 2018. Then there are the massive “electrification” shifts from the likes of Mercedes, BWM, Volvo, Austin Martin, VW, Ford, GM, and others. All now committing to reshaping their companies and the industry by moving to electric vehicles. There’s also that company Tesla which started making their game changing Model 3. Suddenly there’s a lot of competition and if your company isn’t one of those competing…. what are you doing? Those automakers on the sidelines are starting to look obsolete and it’s a short road from obsolete to ‘out of business’.

With automakers and governments committing to electrification of vehicles, we are going to see a significant ramp up in the electric vehicle market. More plug-in options are coming out, billions are being invested, and governments are seriously planning the end of combustion vehicles. It really is a paradigm shift. In large part we have Tesla to thank. If they hadn’t shown the world what was possible, who knows when this would have happened. Certainly the future would be a bit darker.

News

Tesla contract with Baltimore paused after city ‘decided to go in a different direction’

Last Summer, Tesla landed a $5 million contract with the City of Baltimore for a fleet of electric vehicles for the local government. However, Mayor Brandon Scott decided to pause that investment in September after the City “decided to go in a different direction.”

This is according to John Riggin, spokesman for the city’s Department of General Services. Riggin confirmed that the contract with Tesla has not been fulfilled, and Baltimore is going with other options for the time being:

“No Tesla units have been ordered, and none are in the City’s fleet.”

It now seems that the contract, which was set to be run until 2027, is not really a typical “contract” in the sense of the word. Riggin said the city is not obligated to spend the money for vehicles from Tesla, and that it is evaluating offerings from a variety of OEMs, including Ford and General Motors.

Tesla chosen over Ford for $5 million Baltimore City EV fleet

Riggin said the value of the contract is more of a ceiling and not necessarily an obligation to spend the committed amount in full.

The contract has not been canceled officially, but City Comptroller Bill Henry said to the Baltimore Sun that it has gone back to purchasing Mustang Mach-Es from Ford, the vehicle that was snubbed for Teslas back in July when things were initially decided.

The timing of the pause is interesting, and it does not seem to have anything to do with CEO Elon Musk’s direct involvement with the Trump administration, although the EV maker’s frontman was already vocalizing his distaste for the Democratic White House run by the Biden Administration.

Baltimore has a citywide goal of achieving carbon neutrality by 2045, and has used EVs in its fleet for several years to reach that goal. It plans to electrify the city vehicle fleet by 2030.

News

Tesla at risk of 95% crash, claims billionaire hedge fund manager

Tesla stock has been extremely volatile as of late amidst souring sentiments over CEO Elon Musk’s political leanings.

Christer Gardell, a Swedish billionaire and hedge fund manager, issued a stark warning about Tesla stock and what he believes are bubbles in the stock market. The billionaire’s insights about Tesla were shared during an interview with EFN.

Tesla stock has been extremely volatile as of late amidst controversies and souring sentiments over CEO Elon Musk’s increasingly political leanings.

Alleged Tesla (TSLA) risks

Gardell did not mince words about Tesla, stating that the electric vehicle maker’s valuation could drop as much as 95% due to the “circus” surrounding its CEO.

“Tesla, especially now with the whole Musk circus going on everywhere, is probably the most expensive stock on the global stock exchanges right now. It could go down 95% – and maybe it should go down 95%,” he said in the interview.

The Swedish billionaire sees Tesla as fundamentally a car company. Thus, he does not understand why the market has given the EV maker such a high value. For context, the Tesla story has been changing in recent years, with the company growing its energy business and delving into AI and robotics.

Gardell Slams “Eternal Bubble“

Gardell believes the EV maker has become a poster child of sorts of a market that has become speculative, where share prices do not reflect true valuations anymore, as noted in a CarUp report. The hedge fund manager noted that in Tesla’s case, this “eternal bubble” should have burst long ago.

“I have commented that it should have burst over the past five years, but it still hasn’t. The valuation is incomprehensible,” he explained. The hedge fund manager, however, noted that once the crash happens, the decline would be dramatic.

“It’s always hard to say when. It could happen in a month, six months, a year, three years, or five years – it’s impossible to answer. Because there’s so much money dominating the stock market now, and they don’t care about the value of the shares, they speculate on price movements,” he said.

U.S. Stocks Overpriced, Europe Offers Value

Looking beyond Tesla, Gardell flagged broader risks in the U.S. stock market, which he described as significantly overvalued. “American stocks have received very large flows recently. If you look at the American stock market, it is very expensive, both from a purely absolute perspective and from a historical perspective,” he stated.

In contrast, Gardell touted European stocks as a more attractive option for investors. “And the difference between American stocks and European stocks has never been greater. Normally, European stocks have had a discount of 20%, now it is 40%. And that is too high,” he noted.

News

Tesla store shooting incident under investigation

Oregon police are investigating a shooting incident involving a Tesla store.

A Tesla store in Tigard, a city southwest of Portland, was vandalized around 2:00 am on Thursday, March 6.

“The damage was discovered by employees who arrived for work this morning (3/6/25) at the dealership on SW Cascade Avenue. Investigators believe at least 7 shots were fired, damaging 3 cars and shattering windows. One bullet went through an office wall and into a computer monitor. Fortunately, this happened overnight when the property was unoccupied,” stated a Tigard Police report.

Crime scene technicians and investigators are gathering physical and video evidence of the shooting. Tigard Police did not officially announce a motivation for the shooting at the Tesla store. However, they acknowledge that a few Tesla locations have been targeted across Oregon and the nation.

Tesla locations across the United States and abroad have been experiencing attacks recently. Most of the company’s locations experience arson attacks. For instance, in France, around a dozen Tesla vehicles were reportedly torched in a suburb near Toulouse. Meanwhile, in Massachusetts, a few Tesla Superchargers were allegedly set on fire near a shopping center. Tesla protests have also started in various locations.

Police have not provided an official reason or motivation for all the arson attacks and the Oregon shooting because they are still under investigation. However, Elon Musk is definitely at the root of the matter.

Elon Musk has recently found himself the target of plenty of ire in the United States and Europe. Tesla is taking the brunt of all the anger pointed toward Musk.

-

News4 days ago

News4 days agoSpaceX announces Starship Flight 8’s new target date

-

News2 days ago

News2 days agoTesla at risk of 95% crash, claims billionaire hedge fund manager

-

News5 days ago

News5 days agoTesla launches fresh U.S. promotions for the Model 3

-

News2 days ago

News2 days agoTesla contract with Baltimore paused after city ‘decided to go in a different direction’

-

Elon Musk6 days ago

Elon Musk6 days agoTesla mulls adding a new feature to fight off vandals as anti-Musk protests increase

-

Elon Musk3 days ago

Elon Musk3 days agoTesla UK sales up over 20% despite Elon Musk backlash

-

News6 days ago

News6 days agoTesla starts Model Y ‘Launch Edition’ deliveries in the U.S.

-

News7 days ago

News7 days agoTesla’s lead designer weighs in on plans for these two Model Y colors